Mauritius: Wage Relativity Adjustment and Report Changes

The Mauritius Government has implemented changes to the salary scales for employees in various sectors, including those working with attorneys and notaries, in bakeries, construction and quarrying industries, transport, pre-primary education, factories, and many others in the public and private sectors. Including a basic wage for diploma and degree holder workers.

Employers are required to adjust employee salaries/wages appropriately as per the published list.

Employers are required to keep a record of this Wage Relativity Adjustment, in respect of each employee, separately in their payroll and insert that amount as a separate item in their monthly CSG return as from 01 July 2024 and onwards.

The MRA has published guidance that employers are required to declare the following items separately with respect to each employee, when submitting the CSG monthly return:

-

the basic wage/salary (excluding any wage relativity adjustment);

-

the wage relativity adjustment; and

-

a total of the two above items.

Therefore, employers need to split the wage increase as a result of this change and show that separate from Basic Salary/Wage before the adjustment.

Please Note:

Add a new Earning line for Wage Relativity Adjustment on Main Menu > Payroll > Definitions > Earning Definitions > Change Mode.

The following two reports are impacted by these changes in the system:

-

Monthly PAYE Return

-

Monthly PAYE and Contribution Return

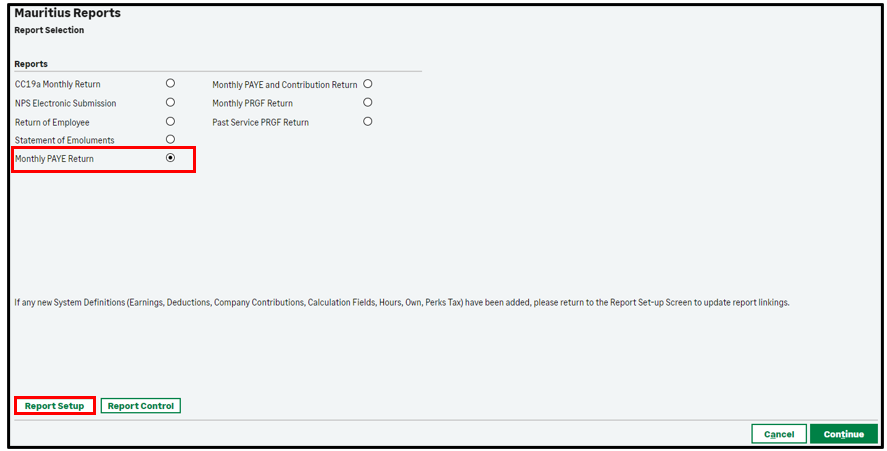

We have amended the Monthly PAYE Return found on the Mauritius Reports Screen:

Before using the report, you must complete the amended selections on the <Report Setup>:

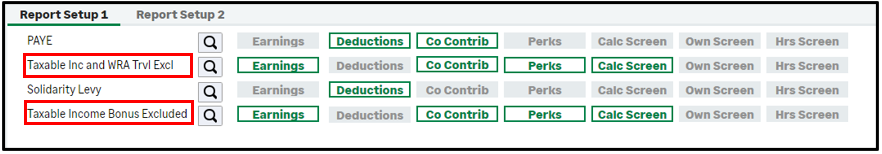

The Report Setup Screen has been amended as follows:

|

Field |

Details |

|

Taxable Inc and WRA Trvl Excl |

"Taxable Income" has been renamed to "Taxable Income and Wage Relativity Adjustment, excluding Travel". Your selections must include Current Taxable Earnings, Benefits and Wage Relativity Adjustment, excluding Travelling. |

|

Taxable Income Bonus Excluded |

"Taxable Income Bonus Excluded" is a new selection and must include Current Taxable Earnings and Benefits, excluding End of Year Bonus. |

The following changes have been made to column headings of the Report:

|

Field |

Details |

|

"Emoluments excluding travelling and end of year bonus" |

"Emoluments excluding travelling and including Wage Relativity Adjustment (MUR)" |

|

"Full Time Employment" |

Moved to print after "PAYE for Income Tax (MUR)" column. |

|

"PAYE Amount" |

"PAYE for Income Tax (MUR)" |

|

"Solidarity Levy Amount" |

"PAYE for Solidarity Levy (MUR)" |

|

|

"Emoluments excluding Exempt Emoluments and Statutory End-of-Year Bonus (MUR)" |

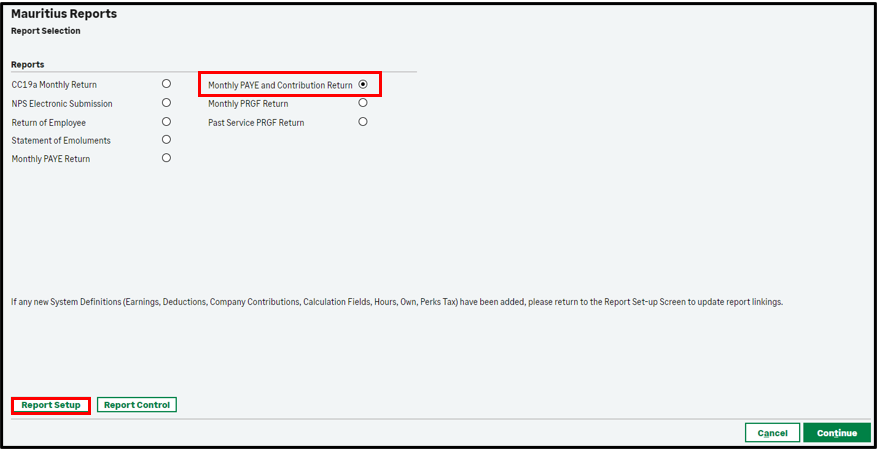

We have amended the Monthly PAYE and Contribution Return found on the Mauritius Reports Screen:

Before using the report, you must complete the amended selections on the <Report Setup>:

The Report Setup Screen has been amended as follows:

|

Field |

Details |

|

Wage Bill excluding WRA |

“Wage Bill excluding Wage Relativity Adjustment" is a new selection and must include all Earnings that make up the Wage Bill but exclude the Wage Relativity Adjustment. |

|

Wage Relativity Adjustment |

Wage Relativity Adjustment" is a new selection. Select the Earning line where you entered the Wage Relativity Adjustment. |

We have added the following columns to the Report:

-

Wage Bill excluding Wage Relativity Adjustment (MUR)

-

Wage Relativity Adjustment (MUR)

-

Total Wage Bill (MUR)

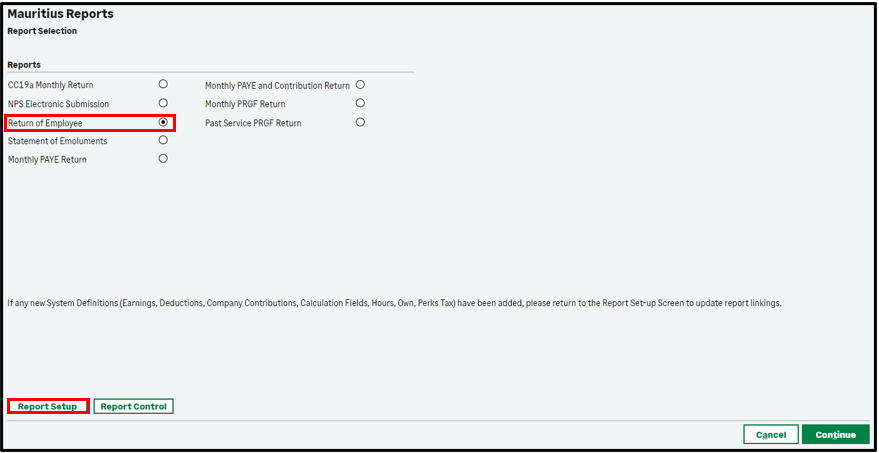

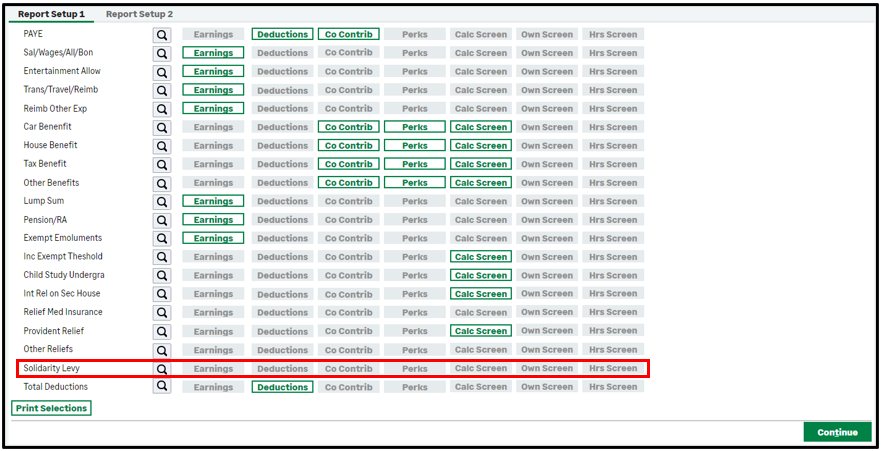

We have amended the Return of Employee found on the Mauritius Reports Screen:

The <Report Setup> has been amended as follows:

|

Selection |

Details |

|

Solidarity Levy |

The linking to Deductions for Solidarity Levy has been remove and the selection has been disabled. |

The following column has been removed from the Report:

-

YTD+ Solidarity Levy Deducted (ROE & SOE)